Optimizing for Success in China with Digital Luxury Group

Discover how luxury brands can optimize their global operations while catering to the unique needs of the Chinese digital consumer, with expert insights from DLG’s Iris Chan and Jacques Roizen.

Hello Tech Powered Luxury listener, and now reader!

🎙️ This week, we are thrilled to bring you an exclusive interview with Iris Chan and Jacques Roizen from Digital Luxury Group, providing expert insights on China's digital ecosystem and the Chinese luxury consumer.

🌟 Are you new here? Welcome to our amazing community - keep reading to discover everything about Tech Powered Luxury, our Community Rewards and how this newsletter came to life.

✨ I’m Beatriz Barros and I’m very excited to have you reading us today!

👀 TL;DR

We’re diving deep into one of the most fascinating and rapidly evolving luxury markets—China. We’re joined by two industry leaders from the Digital Luxury Group (DLG), Iris Chan and Jacques Roizen, who share their expertise on how brands can master the complex digital ecosystem in China and successfully cater to the Chinese luxury consumer.

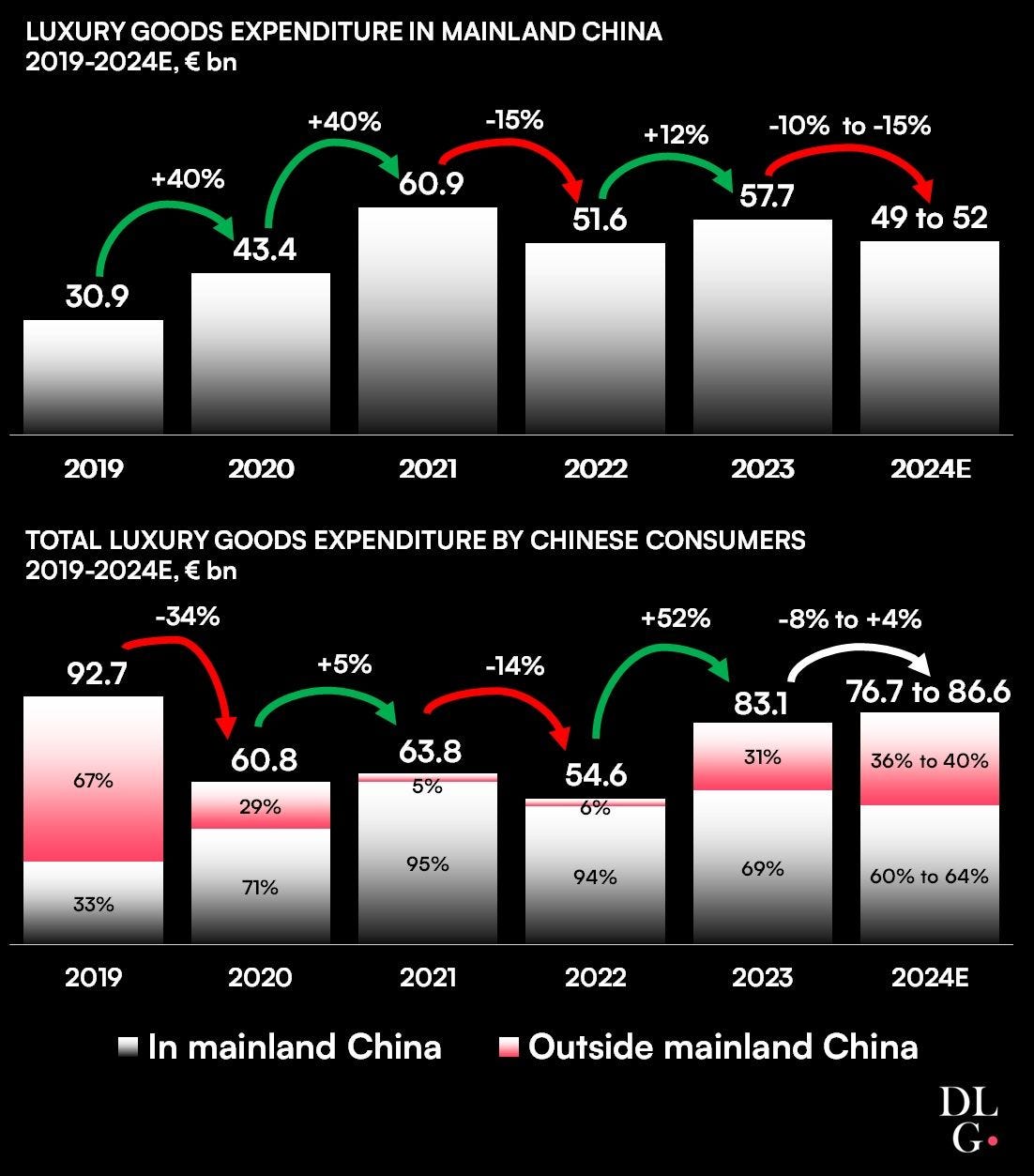

With one third of Chinese consumers now spending more on luxury goods outside of China, brands must rethink their global digital strategies to capture this crucial segment wherever they are.

China's digital ecosystem offers unmatched convenience and speed, but luxury brands must focus on ensuring cohesive online and offline experiences to remain competitive, both locally and abroad, by leveraging data, aligning teams, and adapting to Chinese consumer’s digital-first approach.

🐉 The delicate powerplay of localized strategies to reach the Chinese consumer anywhere, at anytime

The pandemic drastically shifted how Chinese consumers interacted with luxury brands, and the impact of these changes is still being felt. While many brands thrived by focusing on local markets, the return of international travel presents both a challenge and an opportunity: one-third of Chinese consumers are now spending more on luxury goods outside of China.

For luxury brands, this means ensuring they can connect with Chinese consumers whether they’re shopping in Shanghai or Paris. But achieving this involves more than just having a presence in multiple markets—it demands a deep understanding of China’s digital ecosystem and how, in consequence, consumer behavior has evolved the expectation surrounding the luxury experience, “The Chinese luxury consumer has gotten used to the speed, convenience, and rewards of the Chinese digital ecosystem,” explains Jacques.

To remain competitive, brands must adapt their digital and operational strategies both locally and internationally, ensuring that Chinese consumers receive the same high-level service globally.

“It’s important to stop seeing the Chinese domestic consumer and the Chinese traveler as separate entities. They are the same person, and their expectations for service and experience are the same wherever they are.

Brands must use customer data effectively to provide a continuous experience. Whether the consumer is engaging with your brand online in China or shopping in Paris, the touchpoints should feel cohesive and consistent.” — Iris Chan

It doesn’t stop at the experience or level of service. Brand management has to look at this shift strategically, and understand that the downturn in China domestically does not mean the Chinese consumer has less spending power for luxury - quite the contrary, they are simply spending elsewhere.

“Revenue of luxury brands inside China is actually being challenged because so many of these consumers are starting to shop outside China. The problem with that is when your revenue is not growing in China, your first temptation is going to be to right-size your P&L and your cost structure, which means potentially decreasing your marketing investment. And the challenge here is that if you decrease your investment in marketing in China, you're saying ‘I'm investing less in creating desirability and awareness among the Chinese luxury consumers’." — Jacques Roizen

📲 Understand and Optimize

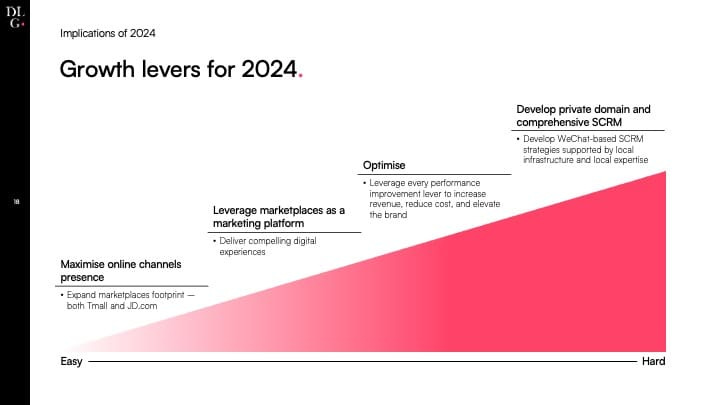

This new market landscape underscores the need for luxury brands to maintain their marketing and desirability in China, even as more purchases are being made outside the country. The secret? Optimizing local operations guided by global strategies to cater to both local and traveling Chinese consumers.

The trick? Having on-the-ground teams that hardly ever needed to face constraints and optimization strategies, because even if they didn’t know exactly how to operate, market conditions were so positive that brands still saw easy double-digit growth.

The game changer for brands is understanding and optimizing their digital presence across all major Chinese platforms—especially Tmall, WeChat Mini Programs, and Little Red Book (Xiaohongshu). These platforms are not just for selling products but are integral tools for storytelling, engagement, and brand-building.

Tmall, for example, is a giant in this ecosystem, and while many brands approach it primarily as an e-commerce platform, they should leverage its broader potential:

"Tmall is not only the most important e-commerce platform in China, but it’s also the most visible window into the world for many luxury brands.

80% of your offline customers are going to go on Tmall with absolutely no intention of purchasing online... They go there in order to find out more information about the brand.” — Jacques Roizen

How does that inform your strategic shift? “If you only focus on generating revenue, you're only going to put entry price products on Tmall, because by definition, the Tmall customer is an entry price customer. But if you're talking to your retail offline customer who's going there only for information seeking purposes, then you have to show her the full extent of the brand”, according to Jacques.

Similarly, WeChat Mini Programs offer a powerful, all-in-one ecosystem where consumers can browse collections, engage with brand content, and join loyalty programs, while Little Red Book (Xiaohongshu) allows for authentic, user-generated content that builds credibility.

These platforms play a vital role in how Chinese consumers interact with brands, from discoverability to transaction, offering endless opportunities to create loyalty and brand advocacy.

Want to discover more about China and the Chinese consumer? Tune in on Thursday to , where Ashley and I will give an exclusive interview on the state of all things China and luxury.

Thank you for reading.

See you next week,

🎁 Community Rewards

This week’s Community Reward is an extention of all things China with the Digital Luxury Group.

We’re offering a complementary perspective on building your brand’s strategy for China with Digital Luxury Group.

Email hello@digital-luxury.com to organise your consultation!

💫 Who are we and what led us here today?

🎙️ Launched as a podcast on November 1st 2022 by Ashley McDonnell, Tech Powered Luxury has since nurtured a vibrant community of experts passionate about the evolving synergy between technology and luxury. We have reached over 20 million people through the podcast, social platforms and media, and have hit +500K downloads.

🪄 Our weekly newsletter is curated by Beatriz Barros, a seasoned expert in luxury and technology based in Milan, Italy. A dedicated collaborator of Tech Powered Luxury, Beatriz applies her expertise as a Fashion & Luxury Business Consultant at Retex—Italy's forefront company known for integrating strategic acumen with operational excellence to solve complex retail-oriented projects for fashion & luxury brands. Additionally, she educates aspiring professionals at Polimoda, renowned for its focus on Fashion Design & Business in the vibrant city of Florence, Italy - also where she first met Ashley during one of her lectures on the future of luxury: a match made in academic heaven. 🌈